JERSEY BENEFIT FRAUDSTERS ARE MONEY LAUNDERERS – HOW LONG BEFORE LOCAL SERVICE PROVIDERS ARE CHECKED?

07/09/2022

In Jersey, in November 2019, a mum-of-four was jailed for a £70K BENEFIT FRAUD. In August 2022, a 53 old woman was jailed for a £110K FRAUD. And now a mum of three has been jailed in September 2022 for £33K FRAUD. Although there are probably more cases, these three stories are summarised below.

However, I wish to highlight that no Jersey bank, IFA, Lawyer, Accountant or other AML-regulated firm has been held to account for providing services and or products to these ladies even though they were benefiting for 10,7 and 4 years, respectively.

THE BENEFIT FRAUD IS MONEY LAUNDERING

- Money laundering is where 'criminal property' [e.g. money from social security] has been gained from criminal conduct [a predicate crime, e.g. benefit fraud], and the benefit is used and controlled by either the fraudster and or another [a third party includes a family member of the fraudster][also a THIRD PARTY could be a financial services provider that provides products and services]

- The FATF defines THIRD-PARTY ML as the laundering of proceeds by a person who was not involved in the commission of the predicate offence [benefit fraud].

MONEVAL

- With Jersey under a spotlight [MONEVAL], can this ever-growing Jersey crime spree of benefit fraud and 3rd party money laundering go unchecked?

REGULATED SERVICE PROVIDERS

- Up to now, no local [Jersey] financial services provider has been helped to account for having a BENEFIT FRAUDSTERS a client.

- However, it can only be a matter of time if the authorities are really wanting to show they are stamping out REAL money laundering.

- As we know, firms in Jersey have been punished for not having systems and controls to prevent money laundering, yet have not been shown to be facilitating [assisting, acquiring, controlling etc.] the proceeds of crime.

- With Jersey under a spotlight [MONEVAL], can this ever-growing Jersey crime spree of fraud and money laundering go unchecked?

X3 JERSEY BENEFIT FRAUD CASES [ALSO MONEY LAUNDERING CASES]

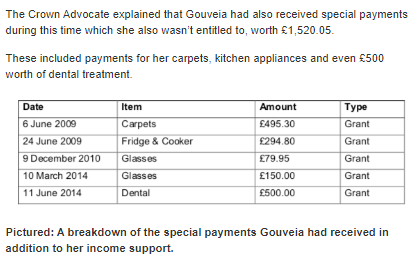

November 2019 Laurentina Martins Gouveia (64) = x10 years of criminal benefits

- She was jailed for a year-and-a-half after hiding the fact she was married, and that she was part-owner of a house in Madeira, to receive just over £70,000 in benefits [over x10 years] that she was not entitled to.

- Charged with two counts relating to the fraud, Gouveia appeared in the Royal Court today (Friday the 15th of November) to be sentenced for her crimes after admitting to the offences.

- https://www.bailiwickexpress.com/jsy/news/mother-four-jailed-70k-benefits-fraud/#.Yxd0WHbMJyE

August 2022 Maria do Carmo Fernandes de Freitas [53] = x7 years of benefit

- A woman who fraudulently claimed almost £110,000 in benefits - despite owning a €99,000 apartment in Madeira - has been sentenced to 15 months imprisonment.

- 53-year-old de Freitas, who has lived in Jersey for 22 years, was never entitled to any pay-outs because she owned property in Madeira - something she repeatedly failed to declare over a period of seven years, resulting in her wrongfully receiving £108,279.94 in Income Support.

- Sentencing Maria do Carmo Fernandes de Freitas, Lieutenant-Bailiff Anthony Olsen told her: "Let us not mince our words: you repeatedly lied. Your claim was dishonest from day one."

- https://www.bailiwickexpress.com/jsy/news/prison-110000-benefit-fraud/#.Yxd1cnbMJyE

September 2022 Gemma Louise Carcel (34) = x4 years of benefits

- The Jersey Evening Post reported on the 6th of September 2022 that a MOTHER-OF-THREE who fraudulently claimed more than £30,000 in benefits had been jailed for nine months.

- Gemma Louise Carcel collected a total of £33,314.46 to which she was not entitled over the course of a four-year period, which Relief Magistrate David Le Cornu described as a fraud on all of us'.

Advocate Simon Crowder, prosecuting, said

- Carcel had failed to tell the authorities about an insurance pay-out of more than £20,000 she had received and regular payments she was getting towards child support - all information that the Social Security Department should have been made aware of.

The Magistrate's Court heard that

- Carcel had been legitimately claiming income support between 2008 and 2016 when the father of two of her children was killed in a road crash in Australia, and she received an insurance payment of more than £20,000.

- 'There were also quarterly payments for child maintenance from her ex- partner's estate.'

The social security department must be informed of a claimant's total financial circumstances before they can make payments.

Advocate Crowder said:

- 'She didn't divulge all the relevant circumstances.

- 'She wasn't entitled to the full amount of income support she had been given. It was a lengthy period of offending.'

Advocate James Bell, defending, suggested that the four-year period during which Carcel had been falsely claiming was a mitigating factor. He said:

- 'This was a large amount of money, but it was paid over a long period of time.

- When you break it down, the amounts are small.'

- From 2008 she had been claiming income support legitimately but said: 'Eight years later, things would go awry.

- She made the poor decision not to declare the Australian monies.

- She has been taking steps to pay back the funds.'

Advocate Bell also pointed out that the risk of Carcel reoffending was low, and she had written a letter of remorse. He argued the impact of imprisonment on her children would be 'disproportionate' and called for her to receive a community service order.

But Mr Le Cornu told Carcel:

- 'You were fully aware of the information you should have declared, you knew your actions were wrong, and you knew you were committing a crime. In a small jurisdiction like Jersey, benefit fraud has a larger impact.

- It's a fraud on all of us.

- This is too serious to warrant a community punishment outcome. You should go to prison.'

The Assistant Social Security Minister, Deputy Malcolm Ferey, said

- It's important for people who receive Income Support to keep the government up-to-date as there are severe consequences for benefit fraud:

- "This case highlights just how quickly overpayments can accumulate when people who claim benefits deliberately fail to inform Customer and Local Services of their change of circumstances in a timely manner.

- "I would urge anyone who realises that they have been overpaid Income Support to contact an adviser and get the correct level of benefit into payment as soon as possible.

- Leaving it will only make the problem worse, which could ultimately end up with a Court appearance and, subsequently, a criminal record.

- "The chances of being caught for making a fraudulent claim only increase with time, and the consequences become more acute."

Anyone who suspects someone is fraudulently claiming benefits is able to anonymously report it online by calling 0800 735 1111 or reporting to the FIU https://jersey.police.uk/about-us/departments/financial-crime-(jfcu)/

SOURCES

- https://jerseyeveningpost.com/news/2022/09/06/mum-of-three-who-fraudulently-claimed-30k-in-benefits-is-jailed/

- https://www.itv.com/news/channel/2022-09-06/woman-jailed-for-fraudulently-claiming-34000-in-benefits

- https://www.islandfm.com/news/jersey/woman-jailed-for-benefits-fraud/

- https://jersey.police.uk/about-us/departments/financial-crime-(jfcu)/

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.