Complex offshore corporate structures or trusts are not immediately dodgy

06/11/2022

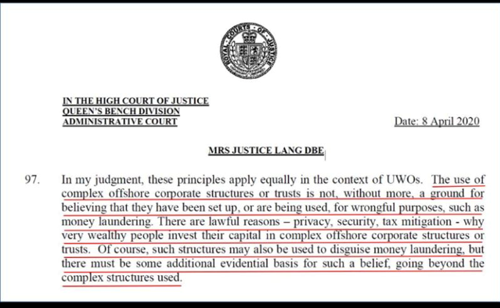

In an application dated 4 September 2019, to discharge three unexplained wealth orders (“UWOs”) and related interim freezing orders (“IFOs”) (together “the Orders”) made by Supperstone J. on 22 May 2019, under sections 362A to 362R of the Proceeds of Crime Act 2002 (“POCA 2002”) MRS JUSTICE LANG DBE made some interesting observations about offshore corporate structures and suspicion.

MRS JUSTICE LANG DBE said:-

- The need for caution in treating the complexity of property holding through corporate structures as grounds for suspicion has been recognised in the context of the risk of dissipation of assets in civil proceedings.

- In Candy v Holyoake [2018] Ch 297, Gloster LJ said, at [59]:

- “Several cases have emphasised that there is nothing implicit in complex, offshore corporate structures which evidences an unjustifiable risk of dissipation.

- As Arnold J put in VTB v Nutrietek [2012] 2 BCLC 437, 517, para 233 (approved by the Court of Appeal ….):

- “It is not uncommon for international businessmen, and indeed quoted UK companies, to use offshore vehicles for their operations, particularly for tax reasons.

- In Candy v Holyoake [2018] Ch 297, Gloster LJ said, at [59]:

- Similarly, in Mobil Cerro Negro Ltd Petroleos de Venezuela [2008] 2 All ER (Comm) 1034, para 62 Walker J rejected that there was anything unusual about the ready transferability of assets within a corporate structure…..”.

- In the present case,

- There was no or only minimal evidence to suggest a risk of the defendants dissipating their assets.

- There was also nothing about either the corporate structure or the ongoing corporate reorganisation that was suggestive of a risk of dissipation……

- There was no evidence in this case that the companies were set up or being used for wrongful purposes; and

- There was no allegation in the claim that any fraud was facilitated by the use of offshore companies (or similar)…”

- The use of complex offshore corporate structures or trusts is not, without more, a ground for believing that they have been set up, or are being used, for wrongful purposes, such as money laundering. There are lawful reasons – privacy, security, tax mitigation – why very wealthy people invest their capital in complex offshore corporate structures or trusts. Of course, such structures may also be used to disguise money laundering, but there must be some additional evidential basis for such a belief, going beyond the complex structures used.

- The Respondents relied upon the principle established in R v Anwoir [2008] EWCA Crim 1354, [2008] All ER 582 where the Court of Appeal held, per Latham LJ at [21], that where the Crown seeks to prove that property derives from crime by evidence of the circumstances in which the property is handled, it must be “such as to give rise to the irresistible inference that it can only be derived from crime” (emphasis added). See also: R v MK and AS [2009] EWCA Crim 952 per Hallet LJ, at [12]; National Crime Agency v Khan & Ors [2017] EWHC 27 (Admin), per O’Farrell J at [27].

Read full judgement here:

https://www.judiciary.uk/wp-content/uploads/2020/04/Approved-Judgment-NCA-v-Baker-Ors.pdf

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.